Ace Economics Masterclass - Major Economic Indicators

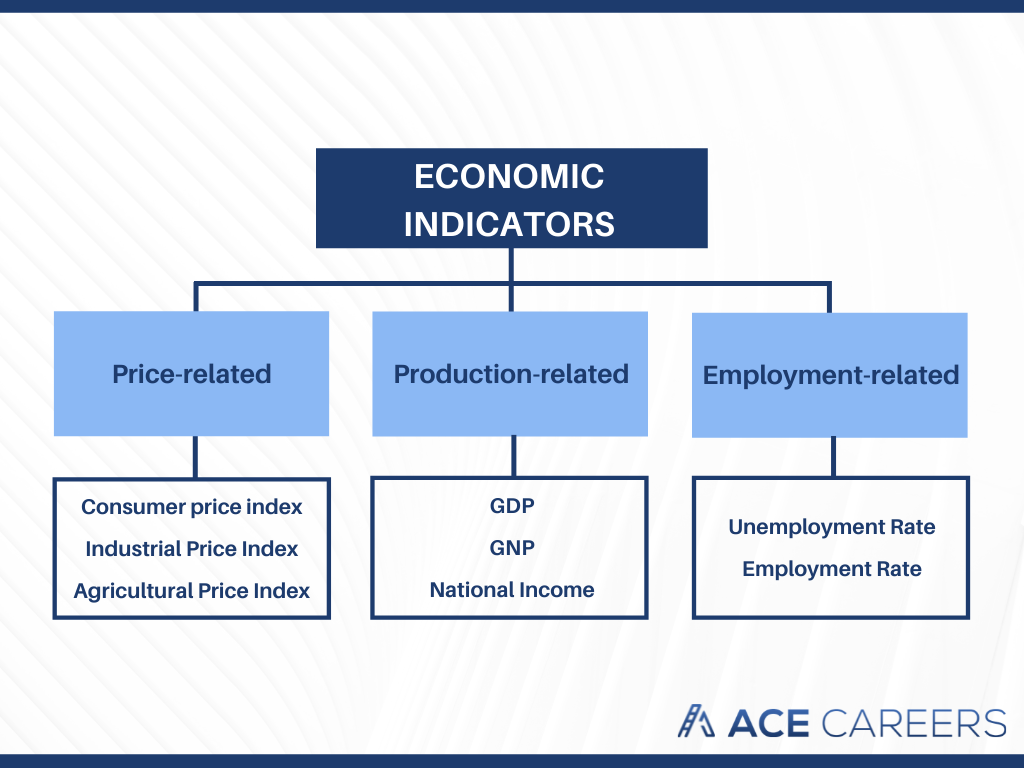

It is hard to say if the economy of a country is strong or not, without some objective indicators to represent the economic performance. Thus, economic indicators are useful for financial analysts to understand the state of an economy and make investment decisions.

During an investment banking interview, we are always asked to give a portfolio pitch based on the macro-economic environment. Below are a few important economic indicators that are frequently seen in all the investment banking reports.

Gross Domestic Product

Gross Domestic Product (GDP) is one of the first indicators that analysts will use to determine the health of an economy. There are two ways to measure the GDP of an economy, income approach and expenditure approach. The income approach which adds up income of everyone and every firm in the economy and less the subsidies and compensation to employees, and the expenditure approach adds up the total consumption, government spending, investments and net export. Released on the last Thursday every month, the GDP figure shows the GDP growth on a quarter-to-quarter (QoQ) basis. An increasing GDP shows an increase in the standard of living of the economy, as income of the whole economy increased, or people are willing to spend more for consumption. Lastly, GDP is also an indicator for economic recession, an economy with the two consecutive quarters of decline in real GDP are generally said to be in recession.

Usually, a higher-than-expected nonfarm payroll figure indicates that the U.S. economy is strong and will likely lead to a stronger U.S. dollar and a higher yield.

Nonfarm Payroll

Nonfarm Payroll (NFP) is one of the most important figures that are used by institutions, investors to analyze the economic activities of the United States. It is a monthly figure released by the U.S. Bureau of Labor Statistics on the first Friday each month. It measures the number of jobs added or lost in the US economy over the last month, and it provides insight for the labor market in the U.S. In the financial market, nonfarm payroll figures have direct impact on the U.S. dollar, treasury yields as well as the gold price. Therefore, traders and financial analysts pay high attention to this data and act accordingly with the released figure. Usually, a higher-than-expected nonfarm payroll figure indicates that the U.S. economy is strong and will likely lead to a stronger U.S. dollar and a higher yield.

Consumer Price Index

Consumer Price Index (CPI) measures the weighted average price of a basket of consumer goods and services, including food, transportation, necessities and medical services, the changes in the CPI is then used to assess the change in cost of living, therefore it is frequently used as an indicator for inflation or deflation. CPI figure is released in the second week every month by the U.S. Bureau of Labor Statistics. While a higher CPI represents a high inflation of the economy, it may not necessarily be good to an economy. Most economists, financial analysts, including the Fed, agree that a moderate CPI within the 2-3% range is good for an economy from the long-term growth perspective. If inflation of an economy is getting too fast, the Fed may need to implement monetary policies to control the inflation to an acceptable level, e.g. rate hikes.

Ace Career Program

The Ace Career Program is the only customized structured career coaching program in the market today to empower undergraduate students to break into Investment Banking, Sales and Trading, Private Banking, Asset Management, Commercial Banking, Retail Banking, Hedge Funds, Private Equity, Consulting and Auditing.

Get in touch with Ace Careers now!

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without Ace Careers' express written consent.

All information contained herein is proprietary and is protected under copyright law.

© 2022 Ace Careers. All rights reserved.